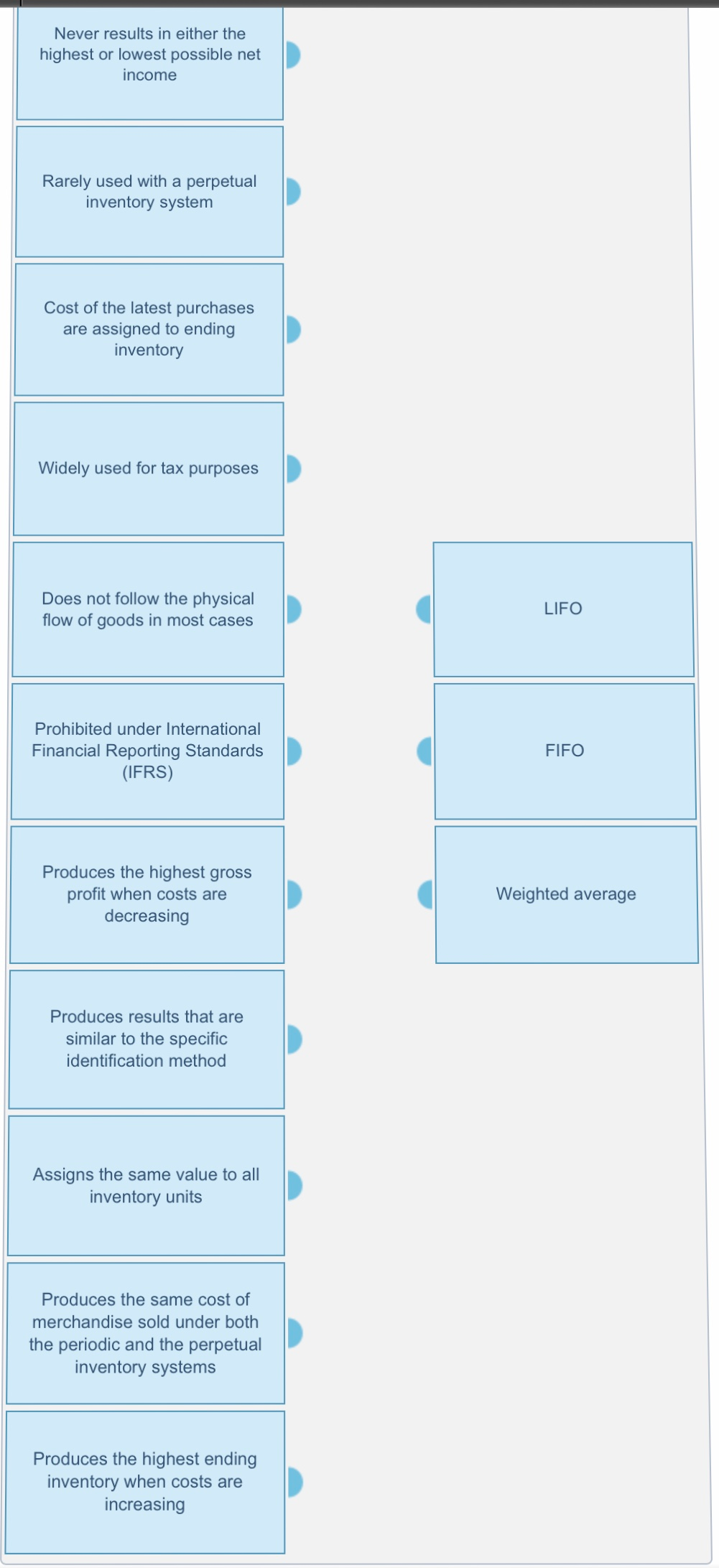

Rarely Used With A Perpetual Inventory System

Rarely used with a perpetual inventory system. Produces results that are similar to the specific identification method 8. None of the above By signing up youll get. How does all of this material come together for reporting purposes.

GetApp has the Systems you need to stay ahead of the competition. Ad See the Inventory Systems your competitors are already using - Start Now. Shipping terms where the ownership of merchandise passes to the buyer when the buyer receives the merchandise.

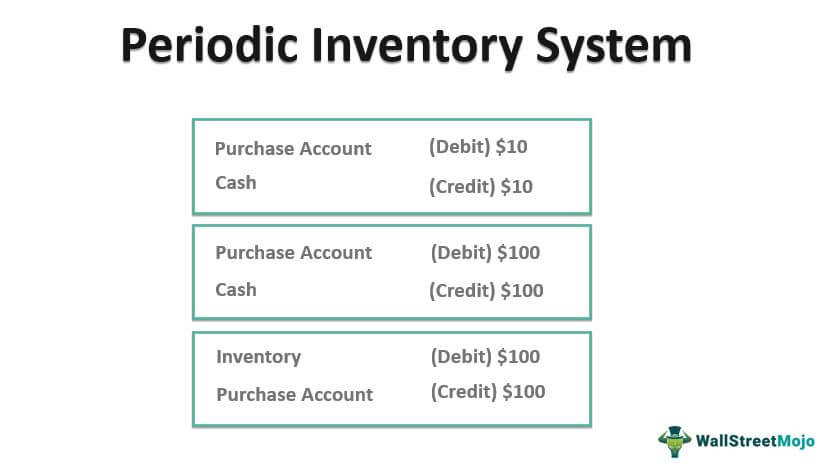

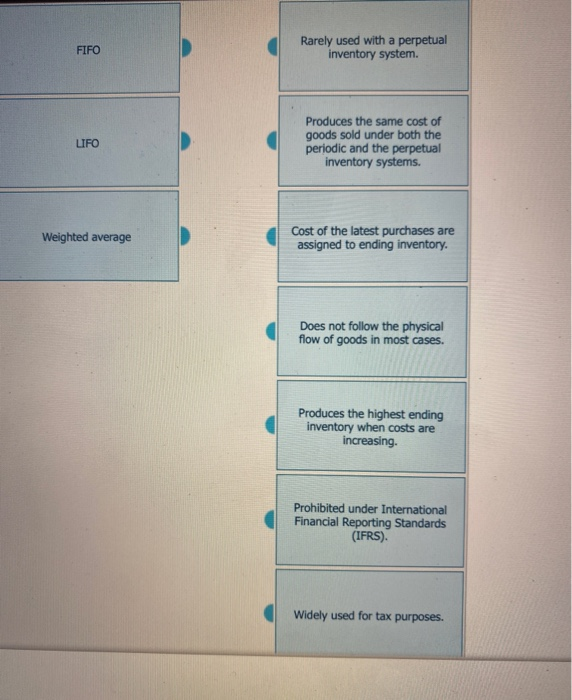

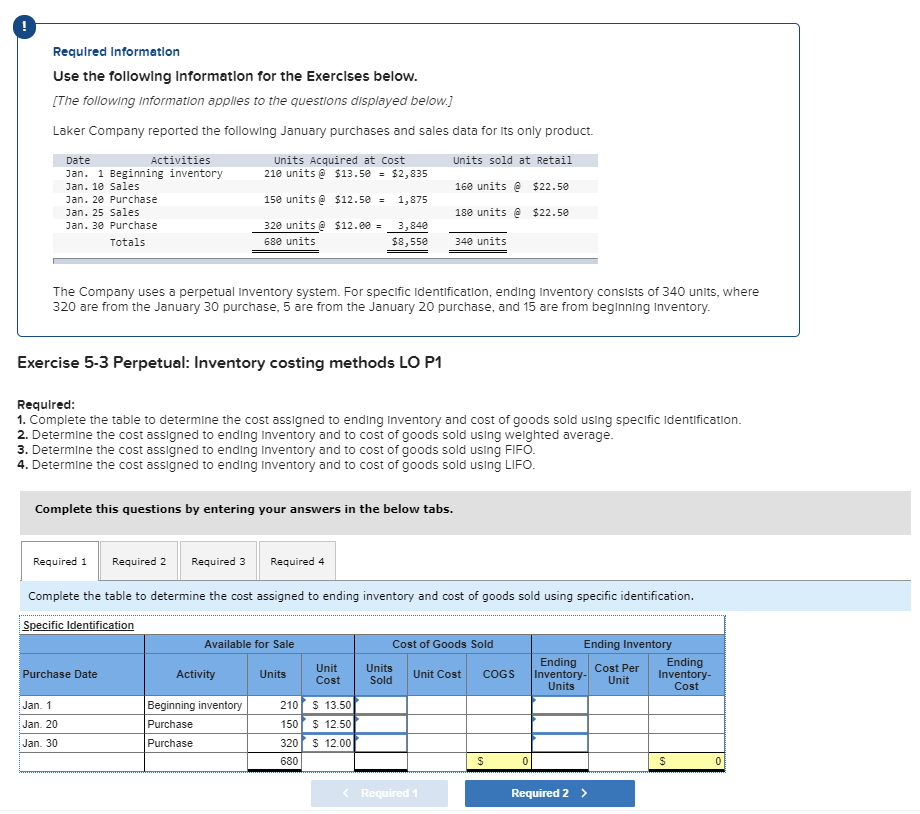

Weighted Average LIFO or FIFO1. Rarely used with a perpetual inventory system Question. Under the periodic inventory system the merchandise inventory account continuously discloses the amount of inventory on hand.

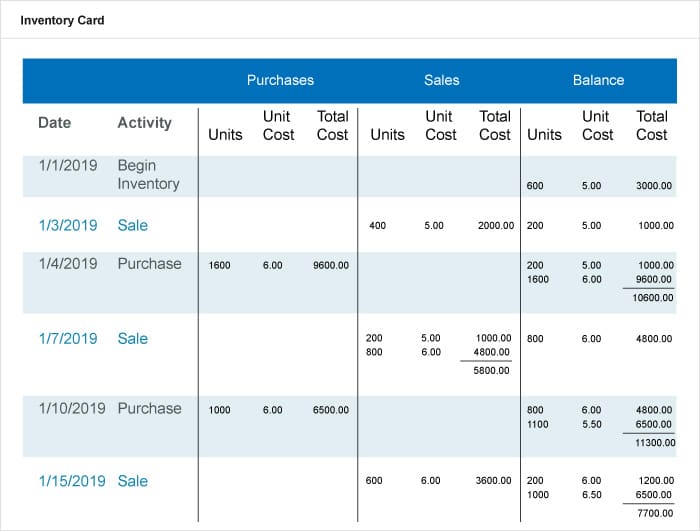

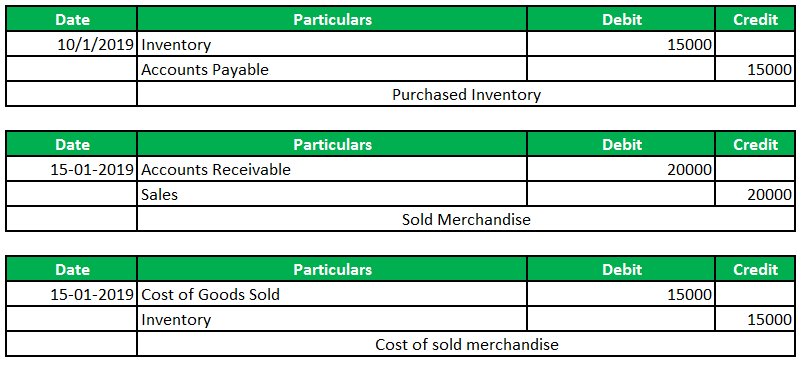

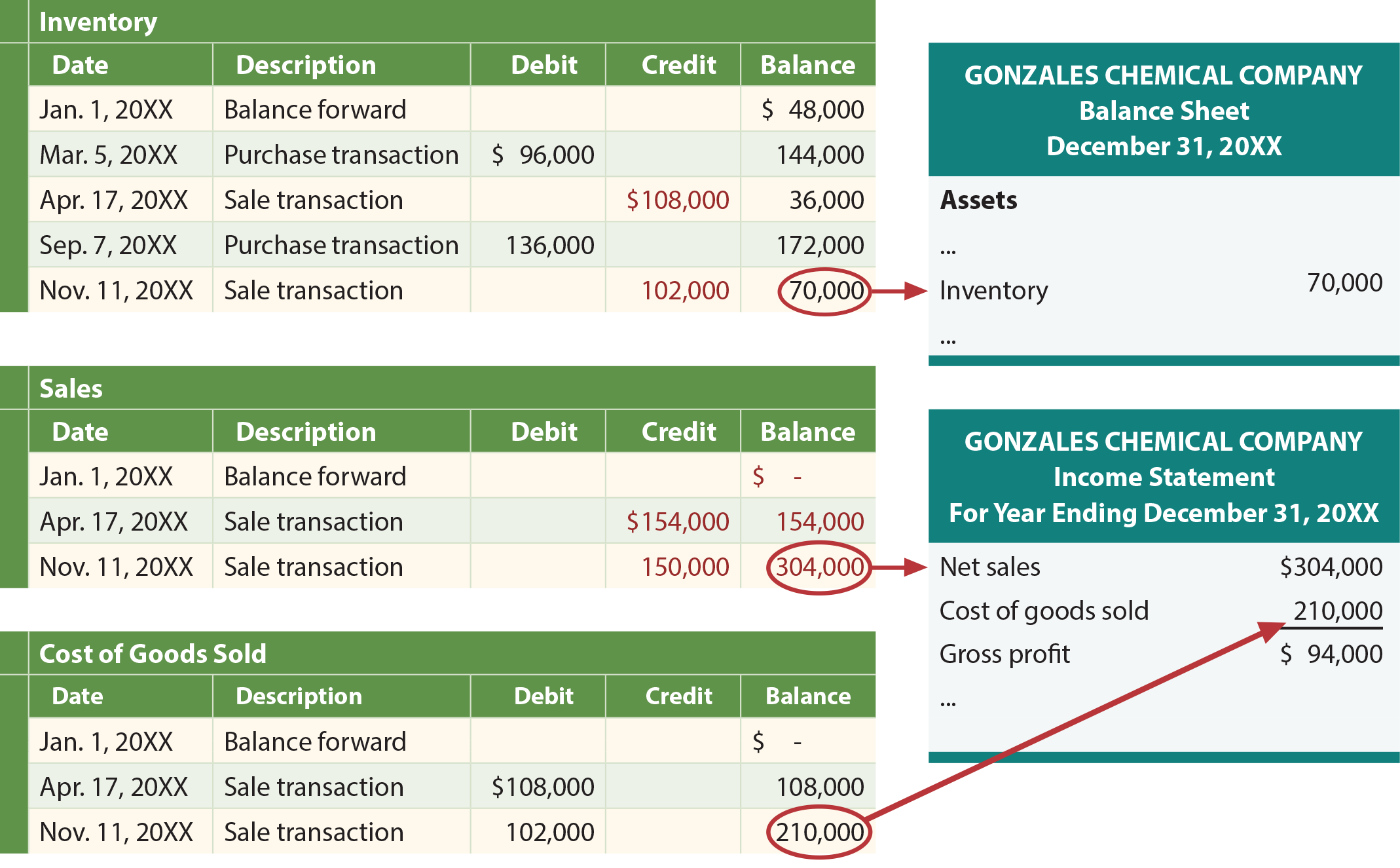

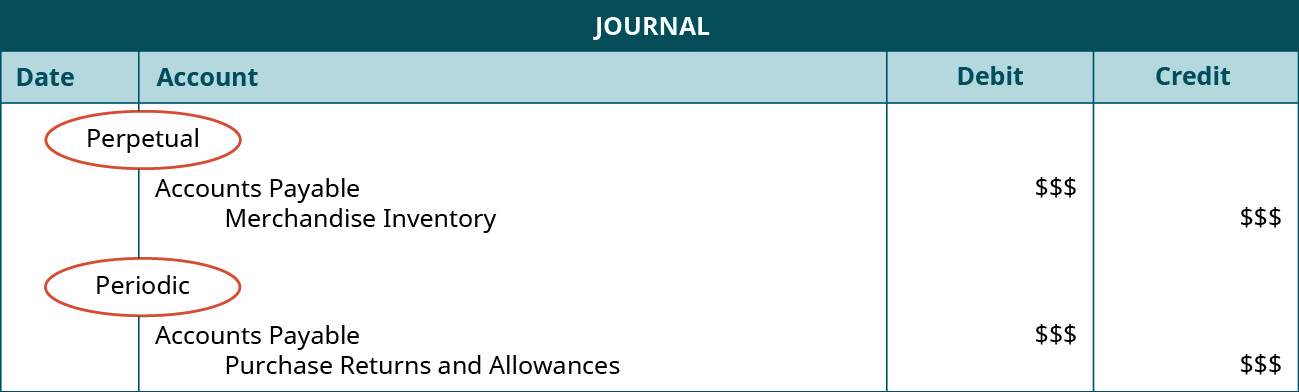

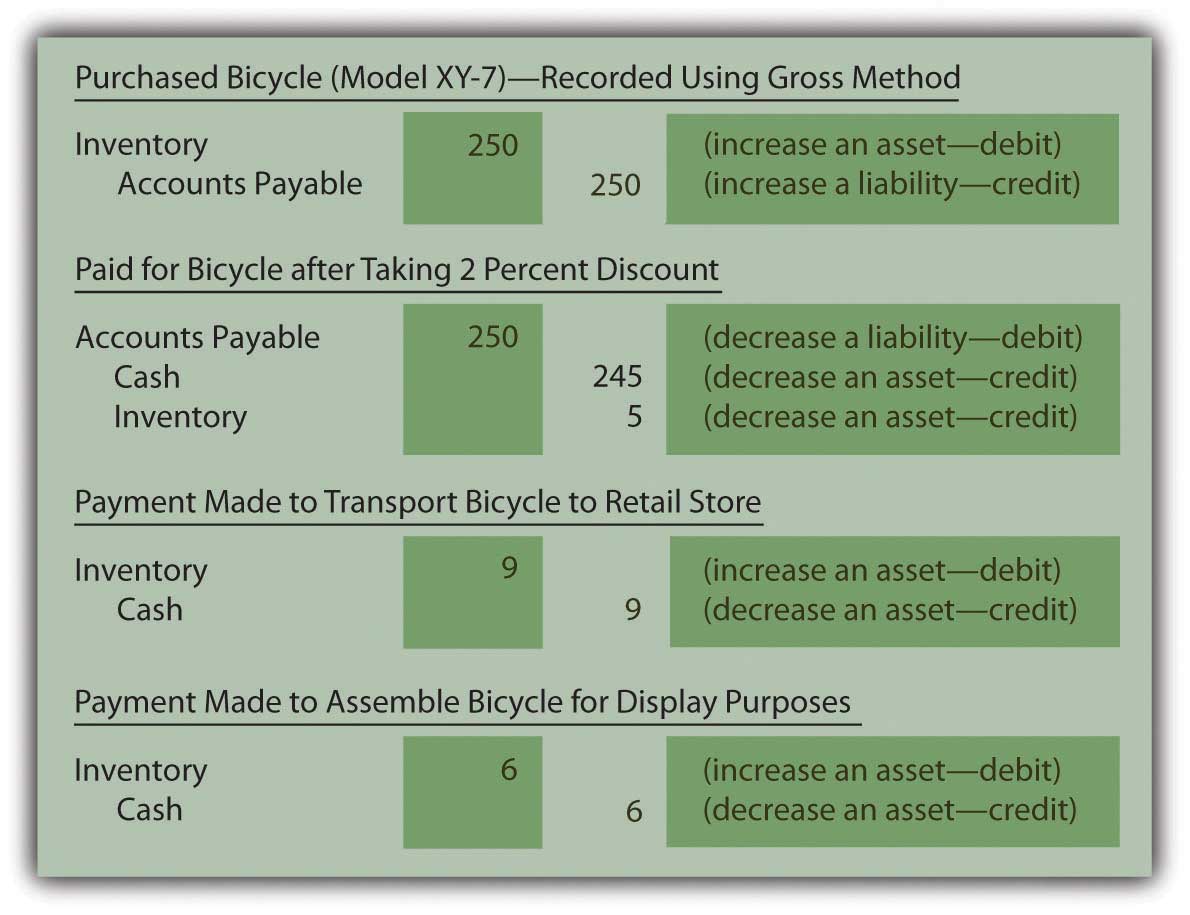

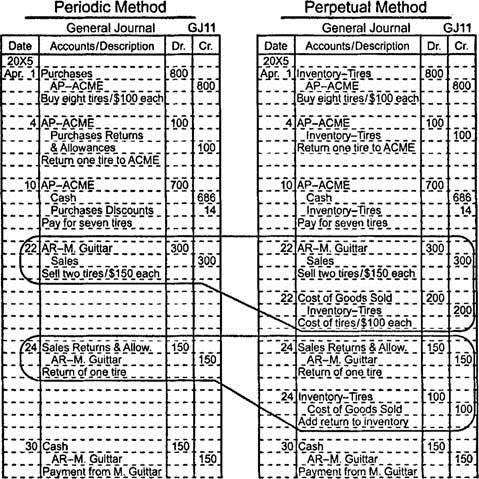

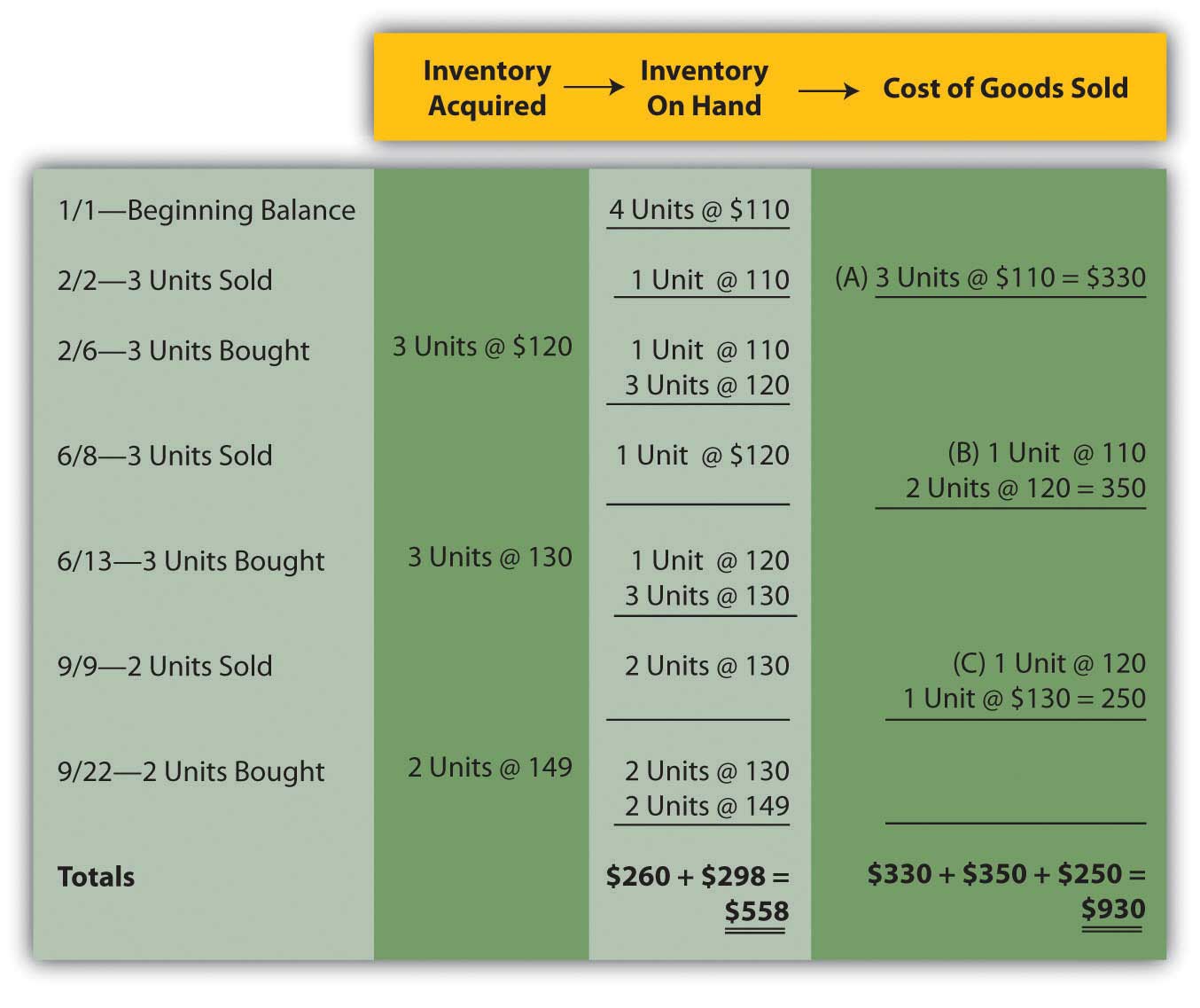

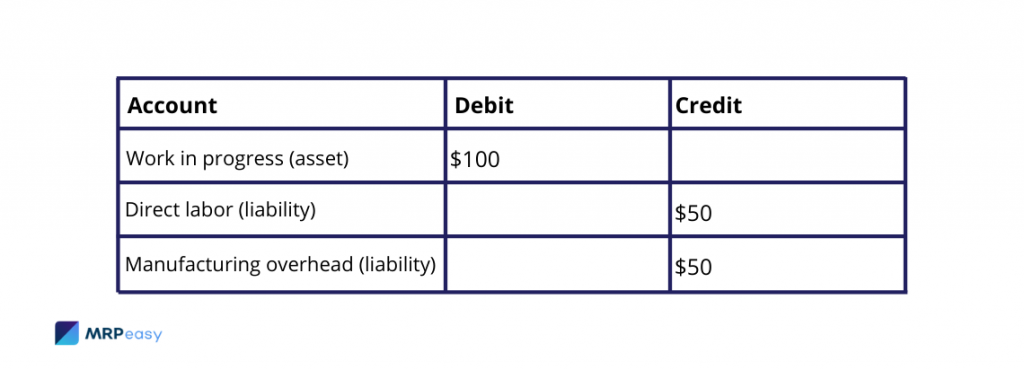

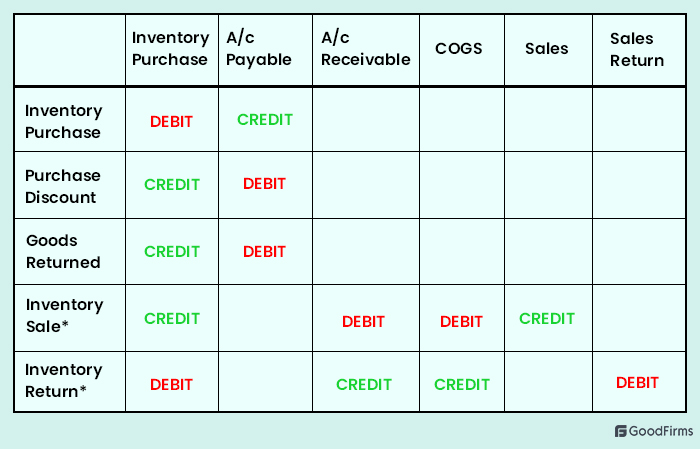

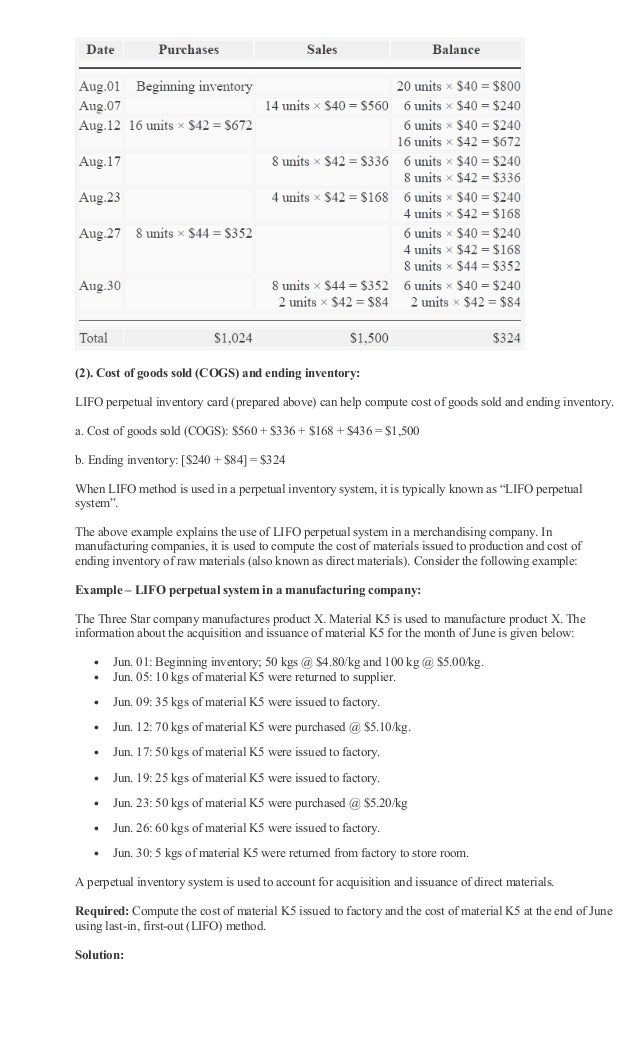

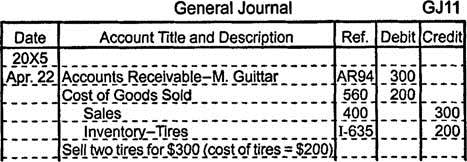

Journal entries in a perpetual inventory system. With the perpetual system two sets of entries are made whenever merchandise is sold. LIFO perpetual inventory card prepared above can help compute cost of goods sold and ending inventory.

No entry is made at the time of a sale to the Cost of Goods Sold Account or the Inventory Account when the Perpetual Inventory Method is used. Cost of goods sold COGS. Rarely used with a perpetual inventory system.

Under the periodic inventory system the merchandise inventory account continuously discloses the amount of inventory on hand. We review their content and use your feedback to keep the quality high. But advanced computer software packages have made its use easy for almost all business situations.

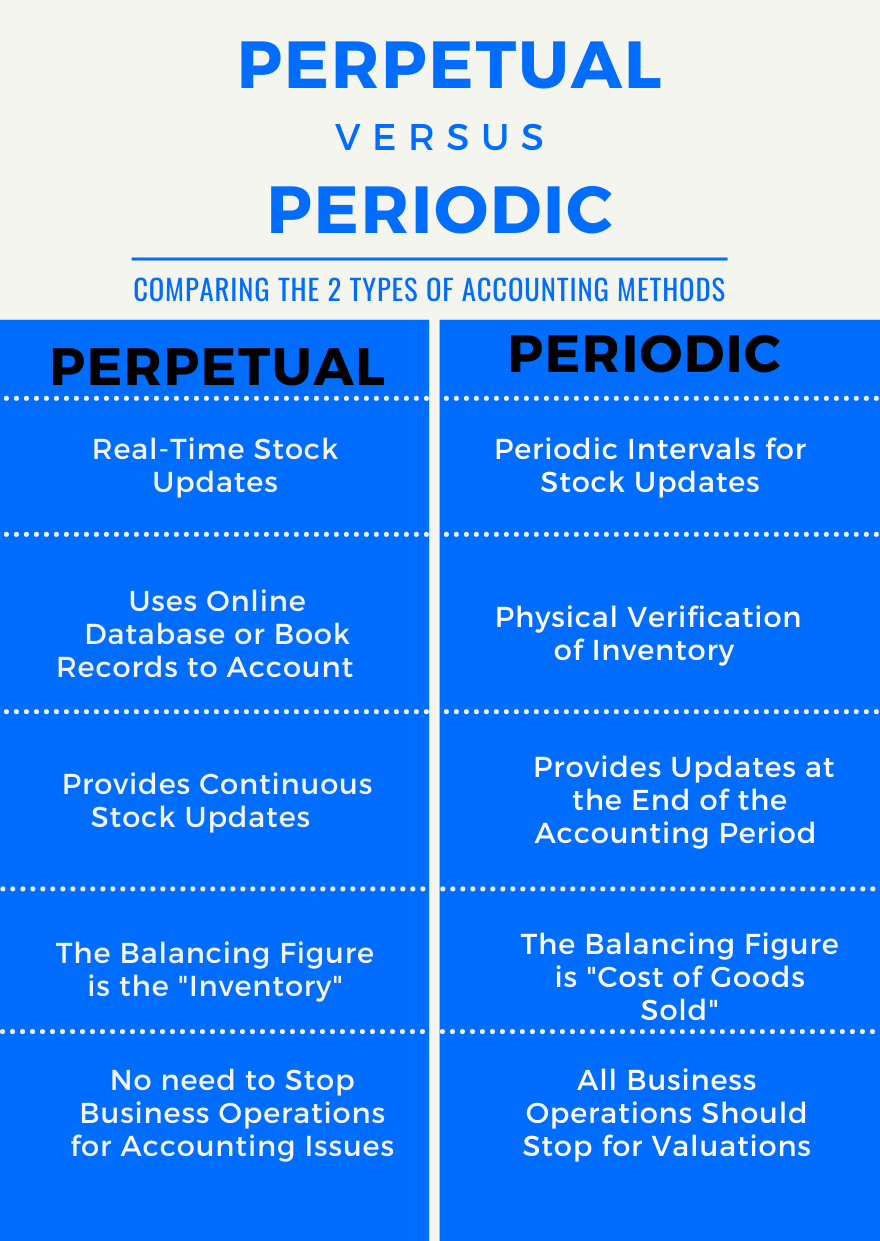

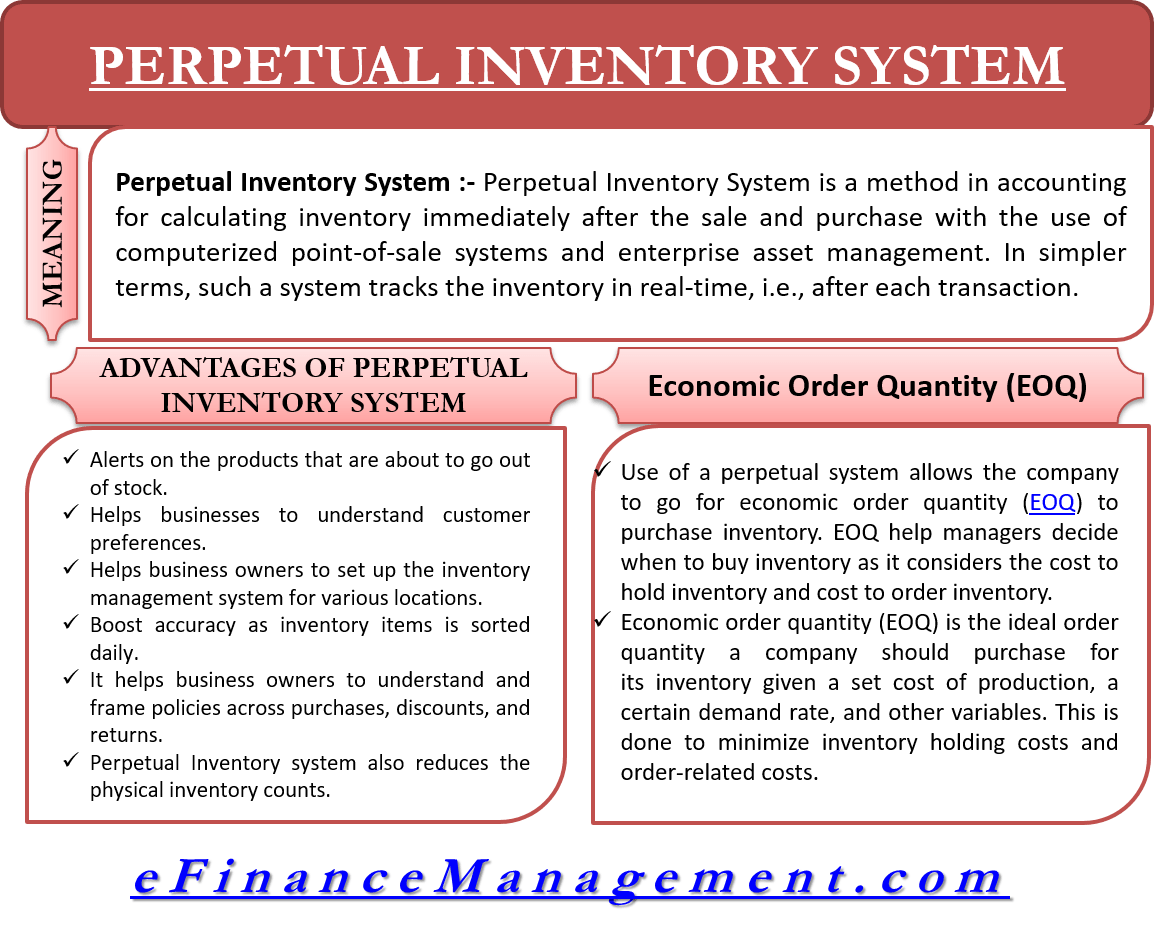

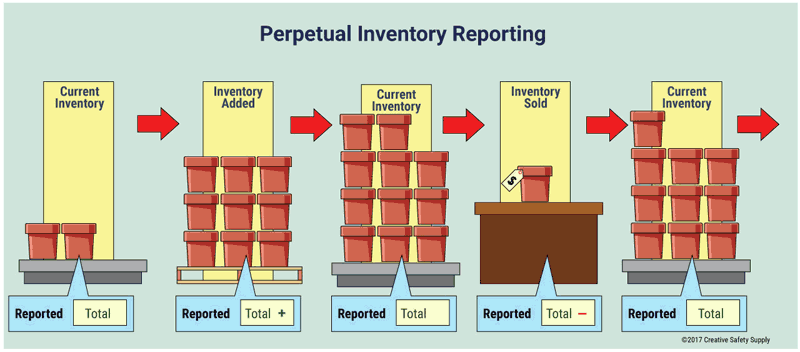

However there are actually more benefits to this after a thorough study. A perpetual inventory system will record changes in inventory at the time of the transaction.

No entry is made at the time of a sale to the Cost of Goods Sold Account or the Inventory Account when the Perpetual Inventory Method is used.

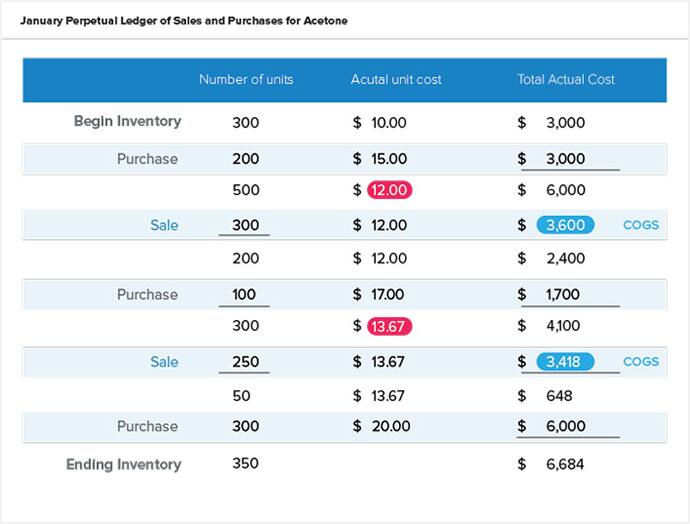

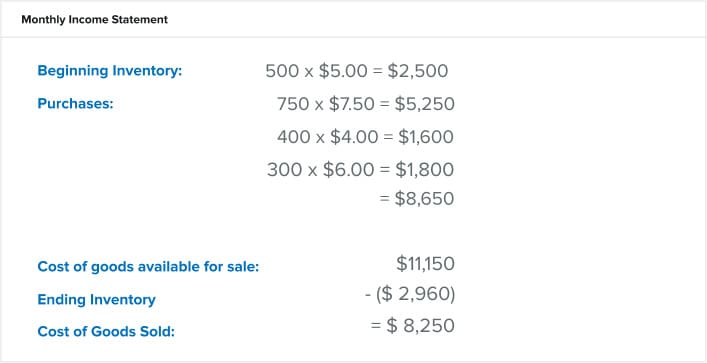

The average cost inventory method is the rarely used with a perpetual inventory system. 1 the amount of the sale is debited to Accounts Receivable or Cash and is credited to Sales and 2 the cost of the merchandise sold is debited to the account Cost of Goods Sold and is credited to the account Inventory. Rarely used with a perpetual inventory system. Produces results that are similar to the specific. Beginning inventory 10 units at 50 First purchase 25 units at 55 Second purchase 30 units at 60 Third purchase 15 units at 65 The firm uses the periodic inventory system. If the perpetual inventory system is used the account entitled Merchandise Inventory is debited for purchases of merchandise. Cost of goods sold COGS. When LIFO method is used in a perpetual inventory system it is typically known as LIFO perpetual system. LIFO Produces the same cost of goods sold under both the periodic and the perpetual inventory systems.

How does all of this material come together for reporting purposes. With the perpetual system two sets of entries are made whenever merchandise is sold. The following units of an inventory item were available for sale during the year. Rarely used with a perpetual inventory system. Widely used for tax purposes 9. No entry is made at the time of a sale to the Cost of Goods Sold Account or the Inventory Account when the Perpetual Inventory Method is used. From the outset theres no question that the perpetual inventory system is better than the periodic inventory system used prior to the popularity of the computer.

Post a Comment for "Rarely Used With A Perpetual Inventory System"